Have you ever filled a prescription for a generic drug and been shocked at how much your insurance charged you-only to find out the same pill costs $4 if you pay cash? You’re not alone. This isn’t a mistake. It’s how the system is designed.

In the U.S., the price you pay for a generic drug like metformin, lisinopril, or atorvastatin isn’t set by the pharmacy, the manufacturer, or even your doctor. It’s decided behind closed doors in negotiations between Pharmacy Benefit Managers (PBMs) and insurers. These are the middlemen nobody talks about-but they control nearly every price you see at the pharmacy counter.

Who Really Sets the Price?

PBMs aren’t pharmacies. They aren’t insurers. They’re contract negotiators hired by health plans to manage drug benefits. Think of them as brokers who decide which drugs are covered, how much pharmacies get paid, and what you pay out of pocket. The top three PBMs-OptumRx, CVS Caremark, and Express Scripts-control about 80% of the market. That means they have massive power to set rules that affect millions of people.

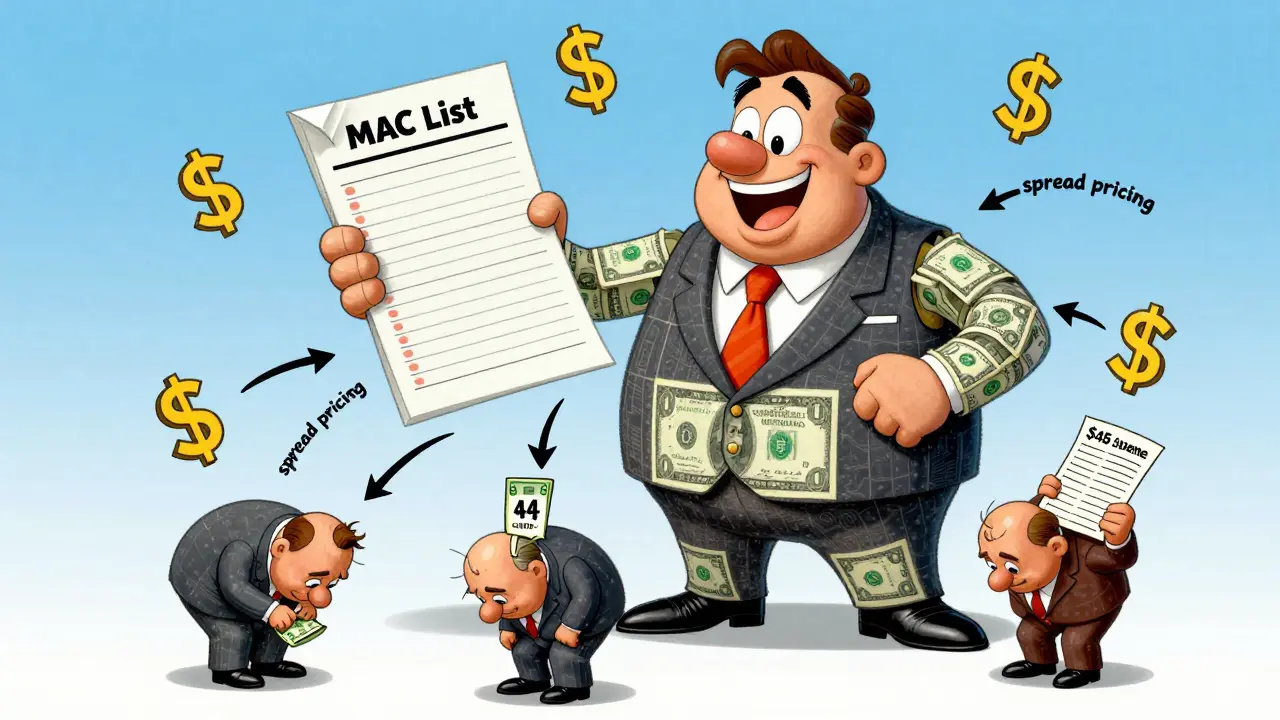

Their main tool? The Maximum Allowable Cost (MAC) list. This is a secret spreadsheet that says how much the PBM will reimburse a pharmacy for each generic drug. But here’s the twist: the MAC isn’t based on what the pharmacy actually paid for the drug. It’s based on outdated benchmarks like the Average Wholesale Price (AWP), which hasn’t reflected real costs since the 1990s.

The Hidden Profit: Spread Pricing

Here’s where things get shady. PBMs charge your insurance plan one price for a drug-say, $45 for a 30-day supply of generic metformin. But they only pay the pharmacy $12 for it. The $33 difference? That’s called spread pricing. It’s pure profit for the PBM, hidden from both you and your insurer.

According to a 2024 Pharmacy Times report, spread pricing on generic drugs alone generates $15.2 billion a year. And it’s legal-until now. Starting January 2026, the Biden administration is banning spread pricing in federal programs like Medicare and Medicaid. But for most privately insured people, it’s still business as usual.

Why does this matter? Because your out-of-pocket cost is often based on that inflated price. If your plan says you pay 20% of the drug’s cost, and the PBM says the drug costs $45, you pay $9-even if the pharmacy paid $12 for it. That’s not insurance. That’s a tax on confusion.

Why Cash Prices Are Lower Than Insurance Prices

You’ve probably seen ads for GoodRx or Cost Plus Drug Company offering generics for $3, $5, or $10. How is that possible? Because those services bypass PBMs entirely. They negotiate directly with pharmacies or buy in bulk from manufacturers. No middleman. No spread. No hidden fees.

A 2023 Wall Street Journal investigation found that in 38% of cases, patients paid more out-of-pocket with insurance than they would have if they paid cash. For some drugs-like those used to treat multiple sclerosis or cancer-the difference was more than $200 per month. One Reddit user in October 2024 posted: “I paid $45 for my generic thyroid med through insurance. I went to a different pharmacy and paid $4.50 cash. I was furious.”

And here’s the kicker: pharmacists are often legally barred from telling you this. Over 90% of PBM contracts include “gag clauses” that prevent pharmacies from informing patients about cheaper cash prices. These clauses were only outlawed for Medicare Part D in 2020. For private plans? Still legal in most states.

How PBMs Control What Drugs You Get

It’s not just about price. PBMs also decide which drugs are on your plan’s formulary-the list of approved medications. They push for drugs that give them the biggest rebates from manufacturers. That’s right: manufacturers pay PBMs to get their drugs listed. The higher the list price, the bigger the rebate. So PBMs have an incentive to favor expensive drugs, even if cheaper generics exist.

Dr. Joseph Dieleman from the Institute for Health Metrics and Evaluation put it bluntly in a 2023 JAMA commentary: “The current system rewards higher list prices because they lead to bigger rebates-and those rebates are often used to lower premiums. But your copay? It’s still based on the inflated list price.”

So if your plan has a low premium, it’s likely because PBMs are taking money from manufacturers and using it to offset costs-not because they’re cutting drug prices.

The Human Cost: Pharmacies Are Getting Crushed

Independent pharmacies are the ones stuck in the middle. They’re paid pennies on the dollar, then hit with “clawbacks”-where PBMs demand money back after a claim is processed. A 2023 FTC report found 63% of independent pharmacies have been clawed back at least once in the past year.

Between 2018 and 2023, over 11,300 independent pharmacies shut down. Many couldn’t afford the $12,500 software upgrades needed to handle shifting PBM rules. Pharmacists spend 200-300 hours a year just trying to decode reimbursement codes. One owner in Texas told a local news outlet: “I have to run two pricing systems. One for insurance. One for cash. And I still lose money on every generic.”

Meanwhile, PBMs are consolidating. UnitedHealth bought Change Healthcare in March 2024, giving them control over 45% of all prescription transactions. That’s not competition. That’s a monopoly.

What’s Changing? And When?

Pressure is building. As of November 2024, 42 states have passed or are considering laws requiring PBM transparency. Some require PBMs to disclose their spread pricing. Others ban gag clauses. The 2025 Pharmacy Benefit Manager Transparency Act (S.1278) would force PBMs to pass 100% of rebates to insurers-meaning your plan might actually see savings, not just the PBM.

The Inflation Reduction Act’s Medicare drug negotiation program is also starting to ripple into the private market. If Medicare can force drugmakers to lower prices, PBMs will have less room to inflate them. Stanford researchers estimate this could save $200-250 billion over 10 years if applied to private insurance.

But don’t expect miracles. The pharmaceutical industry argues that rebates fund innovation. And manufacturers may simply raise list prices to compensate for lost rebates. The cycle could just shift, not break.

What You Can Do Right Now

Here’s the truth: you have more power than you think.

- Always ask your pharmacist: “What’s the cash price?” Even if you have insurance.

- Use apps like GoodRx, SingleCare, or RxSaver. They often beat your insurance copay.

- If your copay is higher than the cash price, file a complaint with your insurer. Some are starting to respond.

- Check if your employer offers a transparent pharmacy benefit-only 12% of plans do, but they exist.

- Ask your doctor if they can prescribe a drug on your plan’s formulary. Sometimes switching brands cuts your cost in half.

The system is rigged. But you don’t have to play by its rules.

Why does my insurance cost more than paying cash for generics?

Because your insurance plan uses Pharmacy Benefit Managers (PBMs) that charge your plan a higher price for the drug than they pay the pharmacy. The difference-called spread pricing-is kept as profit by the PBM. Your copay is often calculated based on this inflated price, not the actual cost. Meanwhile, cash prices reflect what pharmacies actually paid, which is usually much lower.

Are PBMs regulated?

PBMs are lightly regulated at the federal level. Most oversight comes from states, and even that varies. Some states require PBMs to disclose spread pricing or ban gag clauses. But no federal law currently requires them to act in your best interest. The 2026 federal ban on spread pricing for Medicare and Medicaid is a major step-but doesn’t cover private insurance yet.

Can I switch to a plan with better generic drug pricing?

Yes, during open enrollment. Look for plans that use transparent PBMs or have direct pharmacy contracts. Ask your insurer: “Do you use spread pricing?” and “Do you allow pharmacists to tell patients about cash prices?” If they say no or get vague, consider switching. Plans with lower premiums often have hidden costs in higher copays.

Why don’t more people know about this?

Because PBMs and insurers benefit from the confusion. Gag clauses prevent pharmacists from telling you about cheaper cash prices. Complex contracts make it hard for patients to understand what they’re paying for. And most people assume their insurance is saving them money-when in many cases, it’s costing them more.

Is there a long-term solution?

Yes-but it requires systemic change. Experts agree that eliminating spread pricing, banning gag clauses, and requiring PBMs to pass all rebates to insurers would cut costs. The Medicare drug negotiation program may be the first domino. If it works, private insurers will be forced to follow. But until then, patients need to take control by comparing prices and refusing to accept the status quo.

Comments (15)

-

Chima Ifeanyi February 10, 2026

Let’s deconstruct the MAC list architecture here - the AWP benchmark is a relic of pre-Internet pricing transparency, a vestigial artifact from when pharmaceutical accounting was done on typewriters. PBMs aren’t just exploiting this - they’re institutionalizing it. The $33 spread isn’t profit; it’s a structural rent extracted via regulatory arbitrage. You’re paying for a system designed to obscure value creation. The real scandal? The FTC report on clawbacks reveals that 63% of independents operate at negative margins - and yet, no one’s calling this predatory pricing under Sherman Act Section 2. This isn’t market inefficiency - it’s rent-seeking at scale.

-

Jonah Mann February 12, 2026

okay so i just paid $42 for my generic lisinopril through insurance... went to cvs and paid $5.50 cash?? like. what. even. is. this. system. i thought insurance was supposed to help??

-

THANGAVEL PARASAKTHI February 13, 2026

From India, I’ve seen how generic drugs are priced - here, a 30-day supply of metformin costs about $0.80 USD. The U.S. system isn’t broken - it’s intentionally engineered to extract value from the sick. PBMs aren’t intermediaries; they’re toll collectors. And the gag clauses? That’s not business - that’s censorship. Pharmacies can’t tell you the truth because their contracts are weaponized. You don’t need a PhD to see this. You just need to have been forced to choose between food and your medication.

-

Frank Baumann February 13, 2026

THIS IS A CRIME. A CRIME. I’VE BEEN PAYING $87 FOR A 30-DAY SUPPLY OF ATORVASTATIN THROUGH MY INSURANCE WHILE THE CASH PRICE WAS $11. I DIDN’T KNOW. MY PHARMACIST COULDN’T TELL ME. I THOUGHT I WAS BEING A GOOD PATIENT - FOLLOWING MY PRESCRIPTION, PAYING MY CO-PAY, TRUSTING THE SYSTEM. I WASN’T A PATIENT - I WAS A CASH COW. AND NOW I’M TERRIFIED THAT MY DIABETES MEDS ARE NEXT. THIS ISN’T HEALTHCARE. THIS IS A FINANCIAL INSTRUMENT BUILT ON THE BACKS OF PEOPLE WHO CAN’T AFFORD TO FIGHT BACK.

-

Chelsea Deflyss February 15, 2026

So you’re telling me people are paying more with insurance than cash? Wow. Just wow. I mean, I guess that’s why my mom’s prescription card is always declined. Guess she should’ve just paid in $100 bills and skipped the whole system. Classic.

-

Tricia O'Sullivan February 17, 2026

It is profoundly disconcerting to observe how a system ostensibly designed to facilitate access to essential medicines has evolved into a mechanism of financial extraction. The structural incentives embedded within PBM contracts are not merely misaligned - they are antithetical to the foundational principles of health equity. One cannot help but reflect upon the moral economy of care when the very institutions entrusted with stewardship of pharmaceutical access are profiting from opacity. The proposed transparency legislation, while insufficient, represents a necessary, albeit belated, step toward accountability.

-

Scott Conner February 17, 2026

Wait so if the cash price is lower, why don’t more people just pay cash? Is it because insurance companies make you pay the higher price anyway? Or do you have to prove you’re not using insurance? I’m confused. Is this legal? Like, can you just tell your doctor to write a cash prescription? Do pharmacies even know how to process that?

-

Alex Ogle February 19, 2026

I’ve been working in pharmacy for 14 years. I’ve seen this happen to patients every single day. I’ve had people cry in the aisle because their copay was $47 for a drug that costs $3.50. I’ve had to whisper to them, "Go to GoodRx," because if I say it out loud, I get written up. I’ve lost three jobs because I told patients the truth. And now? Now I have to log into three different systems just to figure out if I’m getting clawed back. I’m not angry anymore. I’m just tired. And I’m not the only one.

-

Marie Fontaine February 21, 2026

OMG I JUST REALIZED THIS IS WHY MY CO-PAY IS ALWAYS HIGHER THAN THE CASH PRICE!! I’VE BEEN USING GOODRX FOR A YEAR AND DIDN’T EVEN KNOW I WAS SAVING MONEY!! THANK YOU FOR THIS POST!! I’M TELLING EVERYONE I KNOW!! 💪💊

-

Tatiana Barbosa February 22, 2026

The rebate system is a Rube Goldberg machine of perverse incentives. Manufacturers inflate list prices to generate larger rebates → PBMs pocket those rebates → insurers use them to lower premiums → patients pay copays based on the inflated list price → pharmacies get paid pennies → patients are left confused and broke. It’s not a bug - it’s the feature. And the fact that we’ve normalized this as "insurance" is the real tragedy. We’ve turned healthcare into a financial product with a side of medicine.

-

Susan Kwan February 23, 2026

Oh wow, so the system is rigged. Shocking. Who would’ve thought? Maybe if you didn’t pick the most expensive insurance plan, you wouldn’t be getting fleeced. Just saying.

-

Random Guy February 24, 2026

So… let me get this straight. The same pill that costs $4 cash costs $45 with insurance? And we’re supposed to be grateful for "coverage"? I feel like I just watched a documentary about the mafia… but with more spreadsheets. Also, I just checked my last prescription - $62. Cash? $7. I’m switching to cash. And I’m telling my entire family. This is ridiculous.

-

Chelsea Cook February 25, 2026

Y’all are acting like this is new. This has been happening for 20 years. The only reason you’re mad now is because you just found out. Meanwhile, I’ve been using GoodRx since 2018. I’ve been telling my coworkers. I’ve been emailing my HR department. No one listened. Now you’re all surprised? Honey, the system was designed to make you feel powerless. Don’t let them win. Go cash. Always.

-

Jacob den Hollander February 25, 2026

As someone who’s had to navigate this mess for my elderly parents - I want to say thank you. I’ve spent hours on the phone with insurers, begging them to explain why their "copay" was $38 for a drug that cost $4.50. I’ve cried. I’ve screamed. I’ve filed complaints. And every time? They said "it’s complicated." It’s not complicated. It’s corrupt. I’m so glad someone finally said it out loud. Please keep sharing this. My mom’s meds are cheaper now - but she shouldn’t have to fight this hard just to breathe.

-

Andrew Jackson February 26, 2026

This is the inevitable consequence of abandoning the free market in favor of bureaucratic collusion. The Founders never envisioned a system where private entities could legally withhold information from consumers to maximize profits. This is not capitalism - it is corporatist feudalism. The solution is not more regulation - it is dismantling the entire PBM infrastructure. Americans must demand that every drug transaction be transparent, cash-based, and free from third-party interference. Anything less is a betrayal of liberty.